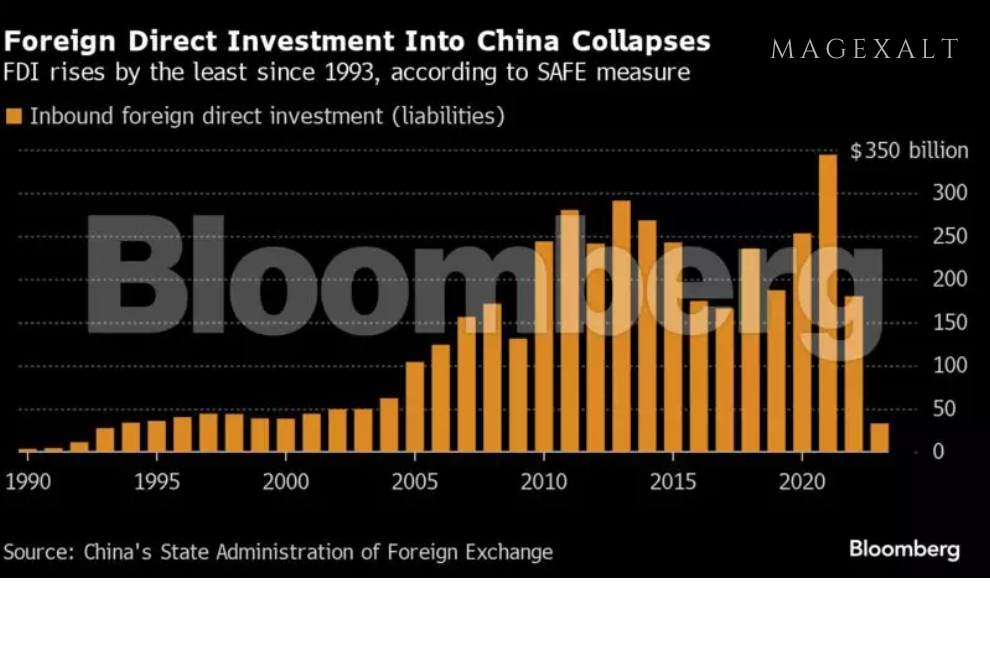

Foreign direct investment (FDI) into China experienced a significant decline last year, marking its lowest increase in over three decades. Data from the State Administration of Foreign Exchange revealed that China’s direct investment liabilities saw a mere $33 billion rise in 2023, a stark 82% drop compared to 2022 figures. The impact of Covid lockdowns and a sluggish economic recovery throughout the year played a pivotal role in this downturn. Notably, FDI fell during the third quarter of 2023 for the first time since 1998, before modestly rebounding in the final quarter. However, even with this recovery, the $17.5 billion influx of new investments was still substantially lower, down by a third compared to the same period in 2022.

Economists suggest that SAFE’s data, which reflects net flows, captures shifts in foreign company profits and adjustments in their operations within China. Indeed, foreign industrial firms’ profits in China experienced a notable 6.7% decline last year, as reported by the National Bureau of Statistics. Earlier data from the Ministry of Commerce also indicated a decline in new foreign direct investment, reaching its lowest level in three years. It’s worth noting that MOFCOM’s figures exclude reinvested earnings from existing foreign enterprises and are considered less volatile than SAFE’s statistics.

This sustained weakness underscores the challenges facing foreign businesses operating in China, attributed in part to geopolitical tensions and regulatory uncertainties. As Beijing continues to seek more overseas investment to bolster its economy, addressing these concerns will be crucial to attracting and retaining foreign capital in the years ahead.